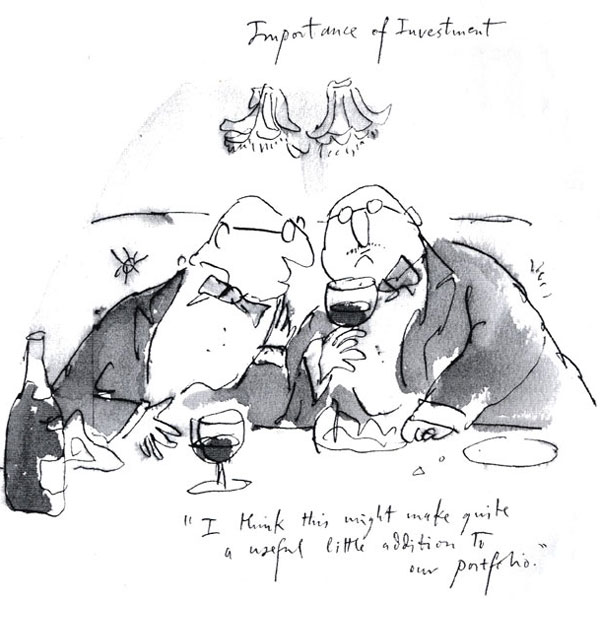

Five reasons for investing in wine.

Fine wine prices have tended to perform well in periods of uncertainty and high interest rates - quickly shrugging off dips after both the financial crash in 2008 and the covid-19 stock market reverse in 2020. In July 2022, the Liv-ex Fine Wine 100 index (the industry benchmark for monitoring prices) closed 0.3% down, the first month it had entered negative territory since June 2020. Over two decades the index had steadily risen over 300%.

Here are five reasons why one might invest in wine:

1. Fine wine itself improves with 20-50 year's age, developing complexity and elegance (should you end up drinking it!).

2. As opposed to financial instruments, the supply-side is finite. So, as you can't print more Petrus 1982, every bottle opened and consumed should push the price of the remainder upwards.

3. Investment wines are deemed to be 'wasting assets' with a predictable life of less than 50 years, so realised profits are not subject to capital gains tax.

4. The performance of wine as an asset class has not correlated to those of mainstream financial assets, so it provides a useful alternative for portfolio diversification.

5. It has a steady, proven track record with annual returns of around 5-10% per annum since 2000.

We have recorded a podcast on the subject highlighting some 'dos and don'ts', which you can listen to here.

See here for further information on wine investment and storage, including our Vintage Portfolio service.